WolfDAO Newsletter - #29

Earn 19.5% APY with UST on Anchor Protocol! Read more about Ukraine legalizing crypto assets, The Graph, Recovery of crypto market, Worldcoin, Katie Haun, and other protocol happenings.

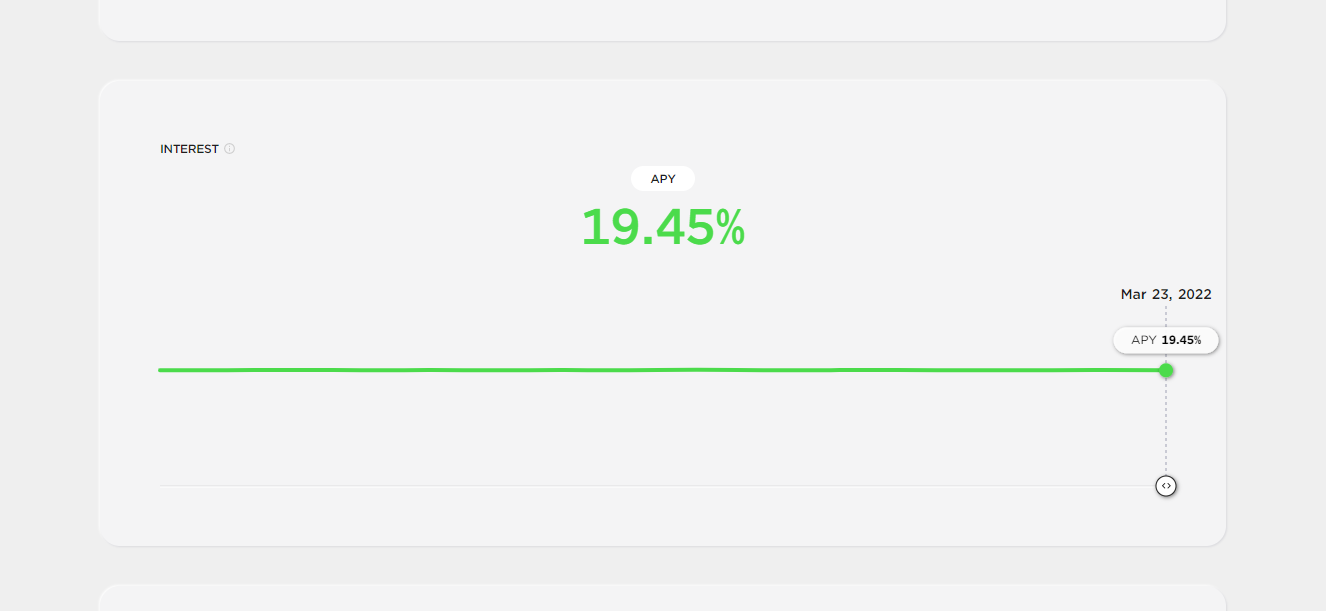

Earn 19.5% APY with UST on Anchor Protocol!

Anchor Protocol is a money market on the Terra blockchain but recently added support to the Avalanche Network. The platform receives its inspiration from Compound, allowing users within the Terra ecosystem to stake their stables to earn yield, deposit approved collaterals (bLUNA and bETH), and borrow UST against them.

Users need to bridge AVAX (or other tokens) via Avalanche Network Bridge to earn significant returns from this staking opportunity. Upon a successful bridging of a value over $75, you will be airdropped 0.1 AVAX for gas fees. Ensure Avalanche is added to browser wallet, and proceed to buy Wormhole UST for staking on Anchor. Head over to the Anchor Protocol’s WebApp, connect the wallet, go to the Earn page, deposit your Wormhole UST, and approve the transaction. You will start earning specified APY on your deposit.

Despite Anchor Protocol being audited, the staking opportunity has market risks, impermanent loss (IL) risks, smart contract risks, etc. We advise only to invest the amount that you can afford to lose.

Source: DeFi Pulse Farmer

After El Salvador, Ukraine Legalizes Crypto Assets

The Ukraine-Russia conflict led to Ukrainian President Volodymyr Zelensky officially signing a law "On Virtual Assets" legalizing cryptocurrency assets in the country.

The law signed by the President clarifies what Ukraine will consider as a crypto asset, taps the National Bank of Ukraine and its National Commission on Securities and Stock Market as crypto regulators, and establishes other regulations surrounding who can offer cryptocurrencies and how they must be registered in Ukraine.

However, the bill is not new as it was proposed last year to the President, who requested some changes. The Ukrainian government first introduced the revised version of the bill on February 17. The signing of law makes it official in the European nation. Deputy Minister of Digital Transformation Alex Bornyakov tweeted that the new crypto law will play a "vital role in Ukraine's defence process."

The Graph (GRT)

The Graph is an indexing protocol for querying data (Ethereum and IPFS), powering many applications in DeFi and the broader Web3 ecosystem. Anyone can build and publish open APIs, called subgraphs, that applications can query using GraphQL to retrieve blockchain data.

A hosted service in production makes it easy for developers to get started building on The Graph, and the decentralized network will be launching later this year. The Graph currently supports indexing data from Ethereum, IPFS, and POA.

Thousands of developers have deployed more than 3,000 subgraphs for DApps like Uniswap, Synthetix, Aragon, AAVE, Gnosis, Balancer, Livepeer DAOstack, Decentraland, and many others. The platform has a global community, including over 200 Indexer Nodes in the testnet and more than 2,000 Curators in the Curator Program as of October 2020.

The Graph team includes professionals from the Ethereum Foundation, OpenZeppelin, Decentraland, Orchid, MuleSoft leading up to the IPO and acquisition by Salesforce, Puppet, Redhat and Barclays. The initial co-founding team includes Yaniv Tal, Brandon Ramirez, and Jannis Pohlmann.

The Graph is working to bring reliable decentralized public infrastructure to the mainstream market. To ensure the economic security of The Graph Network and the integrity of data being queried, participants use Graph Token (GRT). GRT is a work token locked up by Indexers, Curators, and Delegators to provide indexing and curating services to the network.

The Recovery of Bitcoin, Ethereum Led to Crypto Market Back Above $2 Trillion

The continued rally in Bitcoin (BTC) that made it above $43,000 on March 22 helped the broader crypto market recover as the entire industry's market cap is now standing at $2.018 trillion. CoinGecko shows that the last time market went above $2 trillion was on March 3.

Bitcoin is now trading for $42,150 in the afternoon of March 23. Ethereum also helped boost the market as the price soared above $3,000 for the first time since March 2. ETH is also 16.4% up in the past seven days, making it the third-best performing cryptocurrency from the top ten largest assets after Avalanche (AVAX) and Cardano (ADA) only.

Cryptocurrencies have also come under renewed scrutiny in recent weeks as they debate whether people can use them to evade sanctions. Any significant developments on both the geopolitical and regulatory front could thus affect the market, with a possibility of prices moving either way.

Worldcoin is all set to raise $100 Million

According to a recent report, the Eye-Scanning crypto project will raise $100 million funding from venture capital firms Andreessen Horowitz and Khosla Ventures. Worldcoin is an Ethereum-based token aiming to distribute something akin to a universal basic income for all the world's people. It's a cousin to other crypto projects, such as Circles and Proof of Humanity, which are working on initiatives in that same vein.

Katie Haun Raises $1.5 Billion for Web3 Fund

Kathryn Haun was a former partner at Andreessen Horowitz (venture capital firm ), who unveiled her new solo project, Haun Ventures. Katie announced that her fund had raised $1.5 billion to invest in Web3 startups; $500 million is earmarked for early-stage ventures while a whole $1 billion is for companies looking to speed up their growth. Kate wrote, "We're committed to building a web3 ecosystem that future generations will admire," announcing the raise.

Robinhood's New Debit Card to Offer Crypto Rewards

In recent news from Robinhood, the company announced that it's replacing the current debit card offering with a Cash Card that will come with various new investing and rewards features, including the ability to acquire crypto. The debit card targets Gen Z as the card will offer credit card-style rewards with a debit card that comes with no interest or fees. The users can also round up the purchases to invest the pennies into investments.

Goldman Sachs Makes Over-The-Counter Bitcoin Trade—First By Major Wall Street Bank

According to an announcement, Goldman Sachs just became the first central U.S. bank to have made an over-the-counter (OTC) cryptocurrency transaction. The Wall Street giant bought an OTC Bitcoin non-deliverable option (NDO) from Galaxy Digital. An OTC Bitcoin is a contract betting on the future price of Bitcoin—rather than buying the digital asset itself.

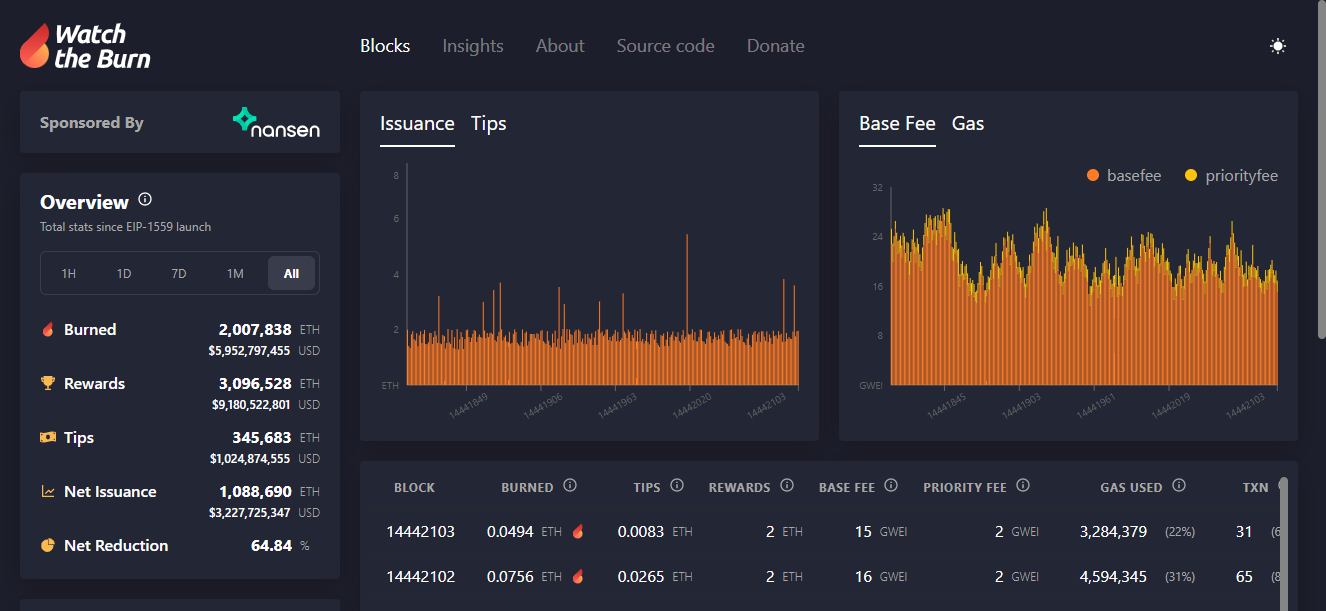

As Ethereum 2.0 Edges, Ethereum destroys more than 2 million ETH via a burn mechanism

The second-largest crypto network, Ethereum, has successfully destroyed over 2 million ETH since the platform introduced the mechanism last August. Since its inception, the network has taken a toll on 2,000,996 Ethereum, which is more than $5.82 billion removed from circulation forever. EIP-1559, the technical name for the burn mechanism, was just one of several updates made to the network.

DAO Treasuries Top $8.2 Billion on Ethereum, $1.3B on Solana: DeepDAO

DAOs are gaining traction in recent times as we can see several people pooling in together for a similar cause. A classic example is UkraineDAO, which collects funds for the people of Ukraine. According to DAO analytics site DeepDAO, there is currently $9.5 billion held in DAO treasuries across all networks, with $1.3 billion held by DAOs built on Solana alone and the remainder ($8.2 billion) on Ethereum.

Optimism Hits $1.6 Billion Valuation After Raising $150M

Optimism (an Ethereum scaling solution) announced that it raised $150 million in a Series B funding round and stood at a valuation of $1.65 billion. The startup wants to make using Ethereum easier and cheaper as several people are using Ethereum to build things and make transactions with its native cryptocurrency. "Sustainable, sub-dollar transactions are no longer a question of if, but when."

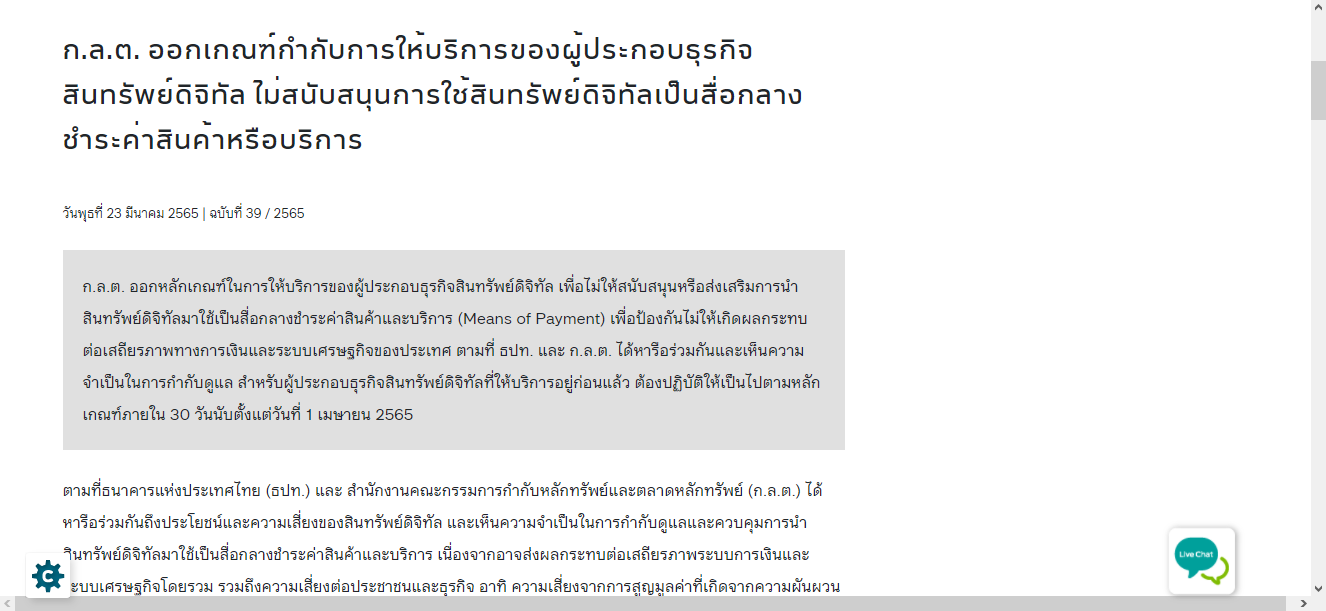

Thailand SEC bans crypto payments, seeks disclosure of system failure from exchanges

The dream to regulate the crypto market for the general public in Thailand was short-lived as the Thailand Securities and Exchange Commission (SEC) announced a ban on using cryptocurrencies for payments. The notice issued by the Thai SEC indicates businesses to not accept crypto payments from April 2022 after discussing its implications with the Bank of Thailand (BOT).